Last June the Supreme Court decided to allow state and local governments to impose sales taxes on online businesses which sell to customers located within their jurisdictions. The case-South Dakota v. Wayfair Inc.- overturned a long-standing decision which allowed state governments to collect sales tax only from businesses which had a physical presence in the state. While experts agree this landmark ruling will increase uncertainty and complexity for e-commerce companies in the coming months, it remains unclear exactly how to best navigate the rapidly evolving tax landscape. In other words, the jury is still out.

What Happens Next?

One thing is certain: tax season is about to get complicated. As a result of its Supreme Court victory, South Dakota can now legally enforce its 2016 law which requires the collection of sales tax by any business which does a significant amount of business (or in legal terms, has “established an economic nexus”) in South Dakota. How does one know whether they have established an economic nexus in a given state? The definition varies by state. In South Dakota, an economic nexus is established by any business which sells $100,000 worth of goods or services or engages in 200 separate transactions in the state annually, and thus is required to collect sales tax from customers in the state. It’s estimated that about 15 other states will have similar tax laws in the books by 2019, with many more to follow soon after. With 50 states and several thousand municipal tax jurisdictions across the country, it’s safe to assume a patchwork of complex tax regulations will soon emerge.

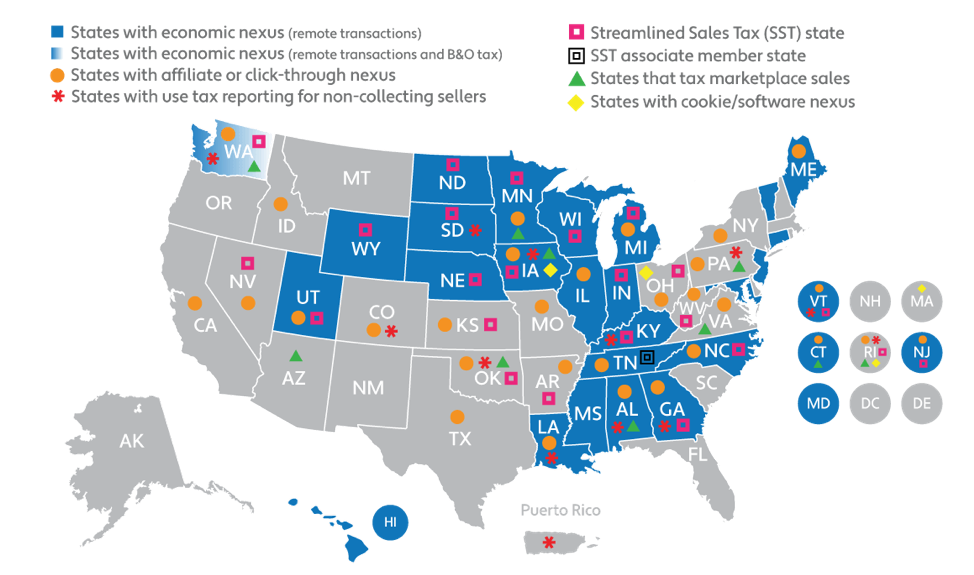

To make matters more complicated, different types of nexuses are starting to appear. For example, in 2008 New York pioneered the “Click-through Nexus” in response to Amazon’s affiliate marketing program. A click-through nexus is established in a given state if a marketer located in that state refers a customer to an online business, even if neither the buyer nor the seller is located in the state. The click-through nexus has since been adopted by Minnesota, Illinois, and several others.

Some different types of nexus regulations appear on the map below.

Does This Change Impact B2B Ecommerce Businesses?

While most of the news has focused on online retailers, the new laws also impact manufacturers, distributors, and other B2B businesses who sell all or some of their goods online.

Sales tax obligations depend not only on the customer’s location, but also on a host of other factors such as the manner in which the seller’s goods are used by the buyer. For example, certain states exempt the sale of raw materials and inventory which will later be resold. For this reason, it’s important to understand how your customers use the goods you sell them. Were the goods purchased solely as a means of production for the business, or for the customer’s personal use as well?

Another factor to consider is the tax-exempt status of your customers. Because ecommerce businesses haven’t been required to collect sales taxes in their customers’ states before, many businesses are unaware of whether their customers possess tax-exempt certificates.

Many B2B businesses have also utilized the services of 3rd party warehousing and fulfilment services. Many states now assert that the presence of physical property in the state, even if stored in a distributor’s warehouse, establishes nexus in that state. This means that B2B businesses need to know not only where and how their products are being used, but also the locations of different fulfillment centers where their products may be stored, and the applicable tax laws associated with each location.

All these factors and many more play a role in a company’s sales tax exposure. The bottom line is that B2B sellers must keep track of locations in which their products are purchased, marketed, and stored, in addition to details of their customer organizations and the manner in which their products are used.

What Steps Should I Take to Prepare My Business?

This news may sound daunting to anyone running an ecommerce business, especially those who are used to paying taxes in only one or a handful of tax jurisdictions. It’s important to get ahead of these changes sooner rather than later, as businesses which fail to comply with state regulations may be held liable for unpaid taxes as well as additional fines and penalties to be decided by each applicable state.

First things first, it’s a good idea to research your supplier and customer relationships in the context of each state’s tax laws. Prices may need re-negotiating due to new tax obligations. Do any of your customers have tax-exemption certificates? What goods are you selling and how do they fit the state’s tax codes? Do you utilize an affiliate marketing program? Your business may have a nexus in a state where you don’t even have customers. If you’re unsure, a state and local tax lawyer can help you determine the steps you must take to avoid penalties.

Next, it’s important to determine which tools your business will use to collect, track, and report sales taxes. Several ecommerce platforms have tax compliance solutions built-in. Alternatively, software from companies such as Avalara, NetSuite, Sovos, and Thomsom Reuters can integrate with your ecommerce platform to manage tax compliance and reporting. These systems can track which product categories are shipped to which zip codes and apply applicable sales tax to each invoice. Additionally, these systems keep track of tax-exempt certificates and taxes collected from customers across the country for audit purposes. The different solutions all have different strengths, weaknesses, costs, and integration considerations, so it’s critical to do some homework on all the different options before you determine which solution best fits the needs of your business.

The new tax laws are sure to cause some anxiety and headaches for ecommerce businesses in the coming months. However, with the right knowledge and tools, you can mitigate risks before they become major problems to your business.